XRP Price Prediction: Bullish Trend Signals Potential 60% Rally

#XRP

- Technical Breakout: XRP trading above key moving averages with improving momentum indicators

- Institutional Adoption: Record futures volume and real-world use cases emerging

- Regulatory Clarity Needed: SEC developments remain a key factor for sustained growth

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerging

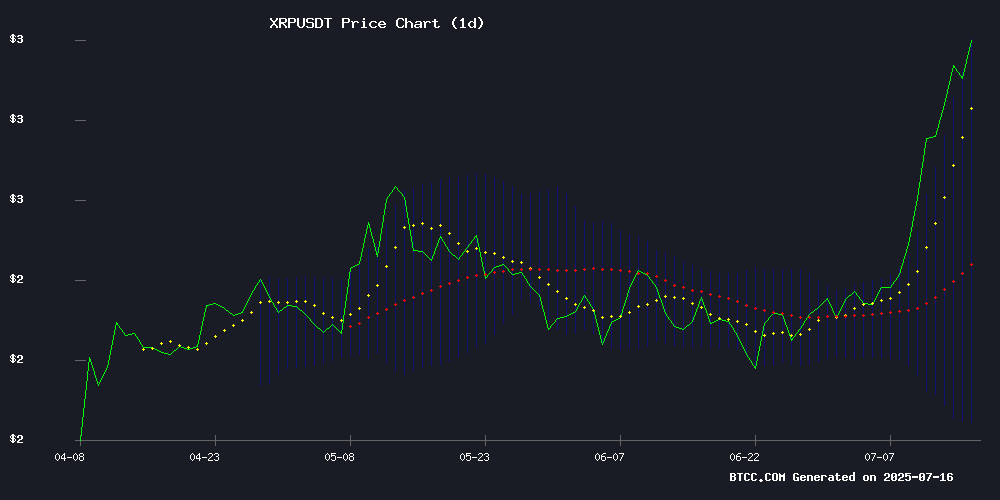

XRP is currently trading at 2.9457 USDT, above its 20-day moving average of 2.4402, indicating a bullish trend. The MACD shows a narrowing bearish momentum with values at -0.2970 (MACD line), -0.1883 (signal line), and -0.1087 (histogram). Bollinger Bands suggest potential volatility with the price NEAR the upper band at 3.0178, while the middle (2.4402) and lower (1.8627) bands provide support levels. According to BTCC financial analyst John, 'XRP's breakout above key resistance and improving technical indicators suggest further upside potential.'

XRP Market Sentiment: Bullish Momentum Builds Amid Key Developments

Recent news highlights strong bullish sentiment for XRP, including a 27% weekly surge and record CME futures volume of $235 million. Analyst predictions range from $3.65 as a key breakout level to long-term targets of $38. Institutional interest is growing with Ripple's real estate tokenization partnership in Dubai. However, BTCC financial analyst John cautions, 'While the momentum is positive, investors should monitor SEC developments and avoid overexposure to short-term volatility.'

Factors Influencing XRP’s Price

Resurfaced McCaleb Interview Reignites Debate on XRP's Centralization and Utility

Jed McCaleb's 2018 CNBC interview has resurfaced, sparking renewed scrutiny of Ripple's governance model and XRP's role in payments. The Stellar co-founder criticized Ripple's centralized validator structure while advocating for open networks during his departure.

Community questions focus on Ripple's escrow releases, validator control, and XRP's utility beyond institutional use. The debate highlights ongoing tensions between enterprise blockchain solutions and decentralized philosophies in the crypto space.

Analyst Identifies $3.65 as Key Level for XRP to Reach $12-$23

Market analyst EGRAG Crypto has pinpointed $3.65 as the critical "Valhalla gate key" that could propel XRP into a two-digit price range of $12 to $23. The assessment is based on a monthly chart analysis tracking XRP's historical cycle tops and mid-cycle tops relative to the 9-period SMA.

XRP's price behavior shows distinct patterns across market cycles. During Cycle 1 (2013-2014), the asset first peaked at $0.0614 before correcting, then formed a mid-cycle top of $0.0280 after bouncing off the 9 SMA. Cycle 2 (2017-2018) saw a mid-cycle top at $0.3988, followed by a six-month consolidation into a bullish pennant before surging to its all-time high of $3.80.

The 2021 bull run produced a mid-cycle top at $1.96, though EGRAG considers this part of an extended cycle rather than a new phase. Current analysis suggests the $3.65 level may serve as the launchpad for XRP's next major price discovery phase.

XRP Holders Warned Against Premature Selling as Bull Run Gains Momentum

XRP is approaching a critical breakout, with crypto analysts urging investors to avoid repeating past mistakes. The token briefly surpassed $3 this week after months of stagnation, fueled by bullish developments including the resolution of Ripple's SEC lawsuit and the introduction of XRP futures ETFs. At press time, XRP trades at $2.92, but market observers anticipate significant upside ahead.

Abdullah Nassif, host of the Good Morning Crypto podcast, emphasized that long-term holders should prepare for substantial gains. "This is just the beginning," he said, citing institutional interest and trillion-dollar inflows through tokenization as key drivers. A guest on the show cautioned against selling during price spikes, advising instead to collateralize holdings and secure them in cold storage or private trusts.

Speculation Mounts Over SEC Dropping Ripple Appeal Ahead of Closed-Door Meeting

Rumors are swirling in the XRP community that the U.S. Securities and Exchange Commission may imminently withdraw its appeal against Ripple. The speculation gained traction after community figure Abdullah Nassif cited an unconfirmed report suggesting the SEC could announce the decision as early as July 17, 2025.

The timing coincides with a scheduled closed-door meeting at SEC headquarters, where commissioners will discuss settlement of injunctive actions and litigation resolutions. Historical precedent shows the regulator often makes significant enforcement decisions following such confidential gatherings.

Market participants are closely watching for potential ripple effects across crypto markets, particularly for XRP, which could see heightened volatility depending on the SEC's action. The meeting agenda specifically mentions enforcement proceedings, fueling anticipation of a resolution in the long-running legal battle.

Crypto Executive Warns XRP Holders: Token Count Alone Won't Ensure Wealth

Jake Claver, Managing Director at Digital Ascension Group, issued a stark reminder to the XRP community: accumulating tokens without an exit strategy is a recipe for financial failure. Despite growing calls from influencers to hoard 10,000 to 50,000 XRP tokens, Claver contends that preparation—not arbitrary targets—determines success in volatile crypto markets.

The warning comes as XRP's value fluctuates dramatically. A 1 million XRP stash currently valued at $3 million was worth just $500,000 eight months ago. While some analysts speculate about $1,000 price targets that would create billion-dollar portfolios, Claver emphasizes that emotional trading and poor planning can obliterate even the most promising positions.

SEC Commissioner Addresses Delays in XRP ETF Approvals

U.S. SEC Commissioner Caroline A. Crenshaw has clarified that repeated delays in reviewing spot-based crypto ETFs, including those tied to XRP, are procedural rather than indicative of rejection. Investors have grown increasingly frustrated as the SEC postpones decisions on multiple filings, such as Franklin Templeton's spot XRP ETF application in June.

Crenshaw acknowledged these concerns during an interview on The David Lin Report, emphasizing the SEC's deliberate, rules-based approach. "The process ensures thorough evaluation, not speed," she noted. The commissioner confirmed that the agency continues to review numerous altcoin ETF and exchange-traded product applications, though no timeline was provided.

Best Crypto to Buy Today: XRP Poised for 60% Rally

XRP surged nearly 25-26% in the week ending July 13, marking its strongest weekly performance since November. The rally appears driven by aggressive whale accumulation and a rare technical pattern. Veteran chartist Peter Brandt identified a "compound fulcrum" setup, suggesting a potential 60% rally to $4.47.

On-chain data reveals wallets holding over 1 million XRP reached record highs, controlling 47.3 billion coins—a 2.2 billion increase since early July. The Net Unrealized Profit-Loss metric indicates XRP is in a "belief-denial" phase, signaling sustained bullish sentiment without panic selling.

Technical analysis points to a critical support level at $1.80. A breakout could propel XRP toward the $4.40-$4.47 range, with some analysts targeting $4.35-$4.40 by month-end. The upcoming ProShares XRP futures ETF, launching July 18, adds further momentum to the bullish case.

XRP Surges 27% in a Week, Reclaims Third-Largest Crypto Spot

XRP has demonstrated remarkable performance in 2025, trading at $2.96 as of July 14—a 27% weekly gain—with its market capitalization soaring to $164 billion. The resurgence cements its position as the third-largest cryptocurrency, fueled by strong institutional interest and speculative momentum. Open interest nearing $7.2 billion underscores this trend.

Institutional adoption has accelerated since May, when CME Group launched cash-settled XRP futures, including micro-contracts for broader accessibility. Whale wallets holding at least 1 million XRP reached a record 2,743 addresses, controlling over 40% of the circulating supply. ProShares’ upcoming XRP futures ETF, set to debut on July 18, marks a watershed moment as the first U.S.-regulated XRP derivatives product. Eleven asset managers, including Grayscale and Franklin Templeton, have filed for similar ETFs.

Regulatory clarity has further bolstered confidence. The SEC’s dismissal of its securities lawsuit against Ripple removed a longstanding overhang. President Trump’s endorsement of XRP’s inclusion in a U.S. digital asset reserve and his public call for ETF approval added political tailwinds. Ripple’s global infrastructure expansion continues to drive utility, with technical indicators now eyeing a decisive breakout above the $3 resistance level.

Ripple and Ctrl Alt Partner to Tokenize Dubai Real Estate on XRP Ledger

Ripple has entered a strategic partnership with UAE-based tokenization platform Ctrl Alt to digitize Dubai's real estate market. The collaboration will leverage Ripple's institutional custody services to store tokenized property title deeds issued by the Dubai Land Department on the XRP Ledger (XRPL).

Ctrl Alt, recently authorized by Dubai's Virtual Assets Regulatory Authority (VARA), will use Ripple's infrastructure for secure storage and lifecycle management of fractionalized real estate assets. This move aligns with Dubai's government-led initiative to modernize property ownership through blockchain technology.

The partnership follows Ripple's growing presence in the Middle East, including its DFSA license approval and recent collaborations with Zand Bank and Mamo. The company has also secured approval for its RLUSD stablecoin within the Dubai International Financial Centre.

XRP Futures Volume on CME Hits Record $235 Million as Institutional Demand Grows

CME Group's XRP futures market is gaining traction among sophisticated investors, with trading volume reaching a record $235 million on Friday. The payments-focused cryptocurrency has seen cumulative trading volume hit $1.6 billion since its May 19 launch, according to CME Active Trader data.

The surge reflects growing institutional interest in regulated crypto derivatives. CME's Bitcoin and ether futures are already established as benchmarks for professional market participation. XRP contracts come in two sizes: standard (50,000 XRP) and micro (2,500 XRP), catering to different investor profiles.

Ripple, the company behind XRP's cross-border payment technology, is pursuing regulatory approvals on both sides of the Atlantic. The firm has applied for a U.S. banking charter and is reportedly seeking a MiCA license to expand its European operations.

XRP Breaks Key Resistance, Analysts Predict Major Rally to $38

XRP has surged past the $2.6 resistance level, a barrier that held firm since March, accompanied by significant trading volume. The altcoin briefly tested $3 before retreating, yet whale accumulation data suggests confidence in further upside.

Technical analyst Gert van Lagen highlights a 7-year double bottom and ascending triangle pattern, historically reliable indicators of bullish breakouts. His chart analysis projects a parabolic move toward $38, citing precedent where similar patterns yielded 2x their initial targets.

Regulatory tailwinds bolster the case: the SEC's approval of ProShares' leveraged XRP ETF has injected optimism into the market. The $2.6 zone now acts as a fair value gap, likely attracting buyers during retracements.

Is XRP a good investment?

XRP presents a compelling investment case based on both technical and fundamental factors:

| Metric | Value | Implication |

|---|---|---|

| Current Price | 2.9457 USDT | Trading above 20-day MA (bullish) |

| MACD | -0.1087 histogram | Bearish momentum weakening |

| Bollinger Bands | Upper: 3.0178 | Near-term resistance level |

| News Sentiment | Strongly positive | Institutional interest growing |

BTCC analyst John notes: 'XRP shows multiple bullish indicators, but investors should consider dollar-cost averaging and maintain a long-term perspective given regulatory uncertainties.'

High volatility asset - invest only what you can afford to lose